Ecb Deposit Rate Floor

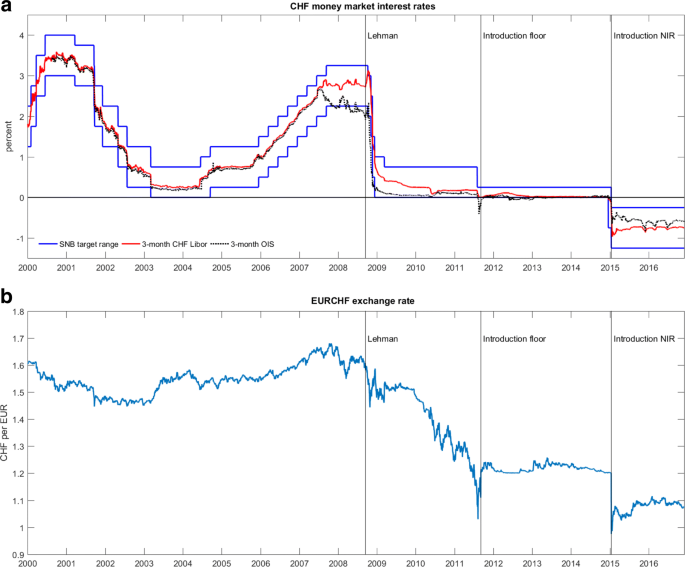

Draghi surprised investors late last month by suggesting policy makers are starting to worry about.

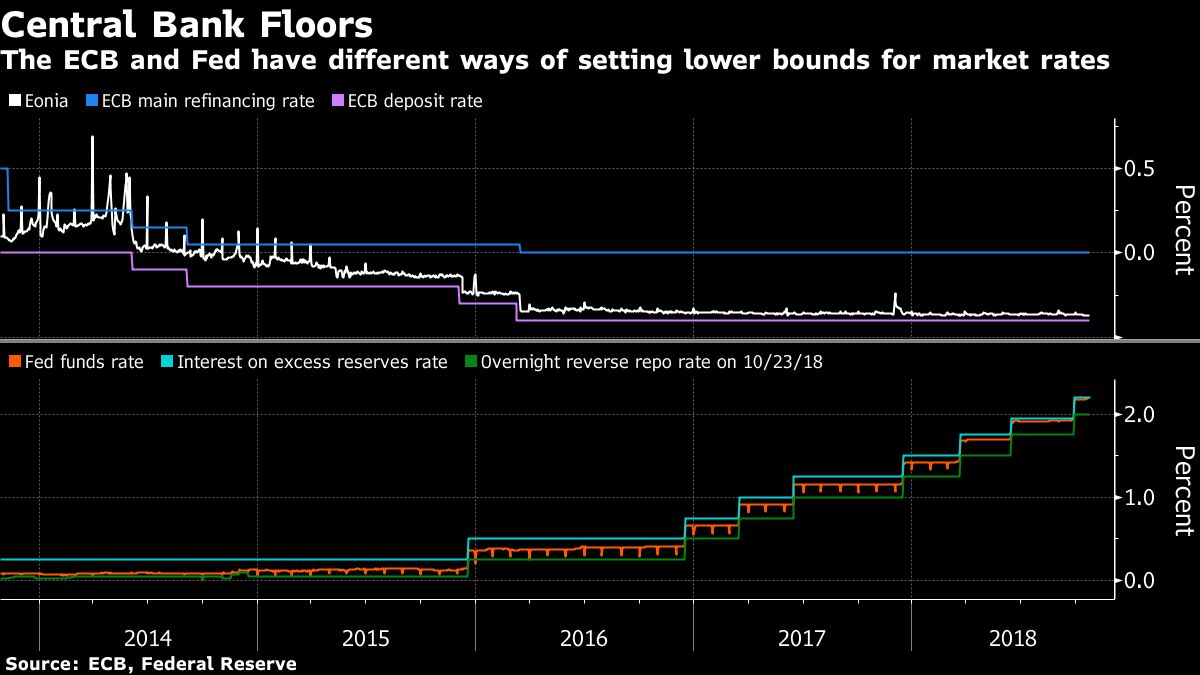

Ecb deposit rate floor. This report has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and that it is not subject to any prohibition on dealing ahead. Euro rates watch ecb to remove floor for qe purchases pdf 257 kb download disclaimer. The euro stood little changed at 1 1259 at around 2 00 p m. The market had been assuming the european central bank was focused on its 1 35 trillion of bond buying and the hundreds of billions of euros it s making available to banks at discounted rates.

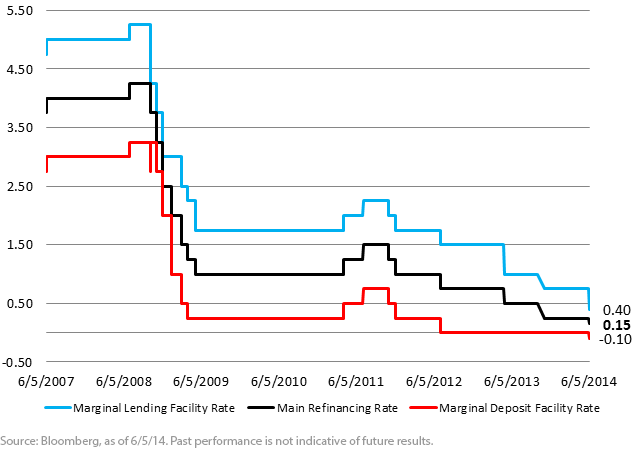

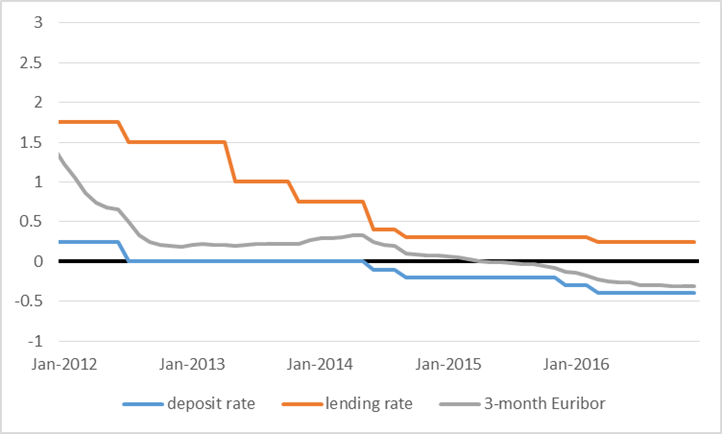

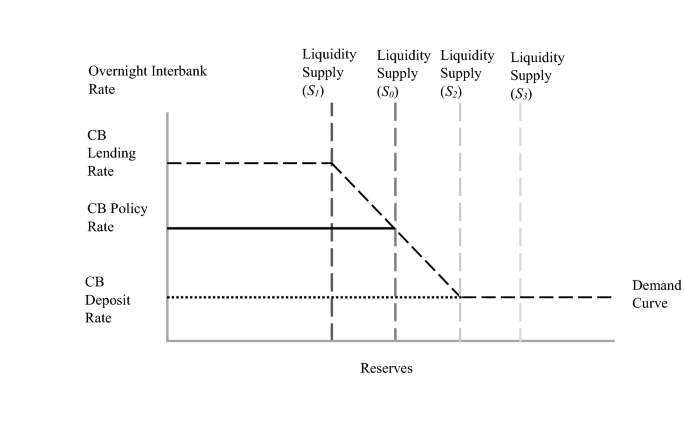

This page provides euro area deposit interest rate actual values historical data forecast chart statistics. Deposit rate rule the other more plausible option is removing the deposit floor rule which would enable the ecb to buy bonds with yields less than minus 0 4 percent. The interest rate on the main refinancing operations mro which provide the bulk of liquidity to the banking system. The ecb kept its deposit facility rate steady at 0 5 on september 10th 2020.

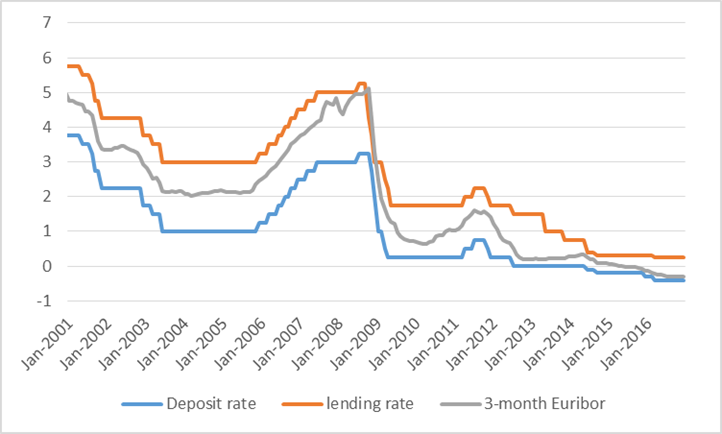

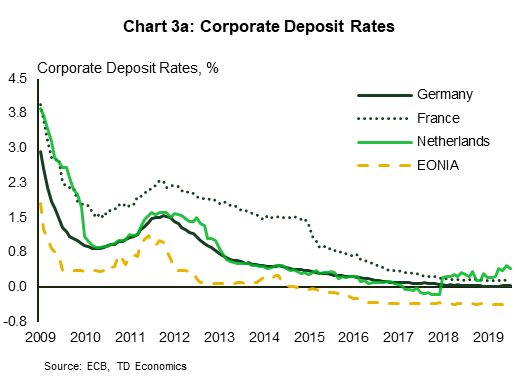

The first is the interest rate paid by the ecb to banks having a deposit for the moment it is the opposite because the rate is negative. The rate on the deposit facility which banks may use to make overnight deposits with the eurosystem. The deposit interest rate is the interest rate paid to deposit account holders for accounts like certificates of deposit cd and savings accounts. Deposit interest rate in the euro area averaged 1 27 percent from 1999 until 2020 reaching an all time high of 3 75 percent in october of 2000 and a record low of 0 50 percent in september of 2019.

The ecb has published explanations of minimum reserves and the deposit facility rate. Key ecb interest rates. The ecb had long played down concerns about the impact of negative rates on bank profits but mr. Interest rates on its marginal lending facility and deposit facility will remain unchanged at 0 0 25 and 0 40 respectively.

:max_bytes(150000):strip_icc()/GettyImages-180734345-ec5247651d704f57a7117eee952be492.jpg)